A multi-step income statement is more difficult to prepare than a single-step income statement. The steps for creating a multiple-step revenue statement for the firm are as follows. Other income and expenses like interest, lawsuit settlements, extraordinary items, and gains or losses from investments are also listed in this section. Unlike the operating section, the non-operating section is not split into subcategories. It simply lists all of the activities and totals them at the bottom. The single-step format is not heavily used, because it forces the readers of an income statement to separately summarize subsets of information within the income statement.

It’s easy to calculate and doesn’t require many steps, which is good for businesses that need accurate numbers without all the details. There are a few ways to calculate revenue from your single-step statement. An income statement is a document that summarizes the revenue brought in by a business, minus all costs incurred to generate that revenue.

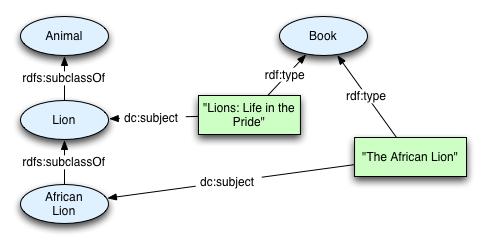

Qualitative Analysis of Companies

This simplified approach makes record-keeping easier for both the accountantswho prepare the statements and the investors who read them. Shareholders need only focus on the net income figure, to gauge a company’s overall vitality. Multi-step income statements provide a more detailed analysis of a company’s revenue and costs, classified by operational and non-operating revenue, for greater insight into the company’s financial health. Small businesses including sole-proprietorships and partnerships are provided an option to choose between single-step or multi-step income statements for preparing their financial statements.

The financial period of a company can vary from being monthly, quarterly, or semiannually to even a full year. A single-step income statement is a format in which all of the expenses, including the cost of goods sold, are listed in one column. Put simply, a single-step income statement does not separate the expenses into categories like the cost of goods sold, operating expenses, non-operating expenses, or other expenses. The detail provided by the multi-step format also can be a drawback. Preparing a multi-step income statement is a more complex and time-consuming process than the preparation of the single-step format. When it comes to comparing a multi-step income statement vs a single-step statement, it is important to consider the type of business you operate.

Single-Step Income Statement FAQs

All publicly-traded companies in the U.S. must adhere to Generally Accepted Accounting Principles , which are accounting standards issued by the Financial Accounting Standards Board . Caroline Banton has 6+ years of experience as a freelance writer of business and finance articles. The Balance uses only high-quality sources, including peer-reviewed studies, to support multiple step income statement vs single step the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, entrepreneur, and advisor for more than 25 years.

- Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others.

- While both formats have advantages and disadvantages, your choice of format depends on what you intend to use your income statement for.

- A Multi-Step Income Statement is a statement that differentiates among the incomes, expenditures, profits, and losses into two important sub-categories that are known as operating items and non-operating items.

- Expenditures like advertising, the salary of a salesman, freight, and commissions are included in selling expenses.

- After gross profit is entered, operating income, interest expense, taxes, discontinued operations, extraordinary items, and other comprehensive income are also presented.

The larger the operating income of a company, the more successful the company may be. The larger income shows that the operations of the company have been profitable before considering other revenue and expenses. It is important to know a business’s income before and after taxes, as shown in the income statement.Other revenues and expenses are items not related to the operation of the company. Common forms of other revenue and expenses include interest income, interest expenses, and dividends. Usually most of the revenues and expenses come from investments, as they are a common source of revenues that do not directly come from the company’s operations. The main difference between the single-step income statement and the multiple-step income statement is the presentation.

Income Statement vs P&L Statement

Gross profit is used by creditors to show the company’s ability to meet arising debt obligations and to pay back outstanding credit. An income statement is one of the four primary financial statements. It may go by other names, including the profit and loss statement or the statement of earnings.

- This is the amount of money the company made from selling its products after all operating expenses have been paid.

- An accounting standard is a common set of principles, standards, and procedures that define the basis of financial accounting policies and practices.

- It shows how profitable a company is in manufacturing or selling its products.

- The single-step income statement looks only at the company as a whole and does not differentiate between operating and nonoperating income.

- This example of a single-step income statement gives you an insight into the final report.

- It is usually known as a Trading Account, where Direct Incomes and Expenses are mentioned.

Non-operating revenues and expenses are then added to or subtracted operating income in order to calculate income before taxes. Non-operating items are those revenues and expenses that do not pertain to the company’s normal operations such as dividend income, interest income and expense, and income tax expense. This gives you how much operating income your business can generate while managing fixed operating costs. Your total operating expenses are subtracted from gross profit, from the previous section, to show operating income. Follow along with our quick guide to build your own multi step income statement. Start with your gross sales revenue, then move through each section reporting accounts on the left and totals on the right.

Lauren Ward is a personal finance expert with nearly a decade of experience writing online content. Her work has appeared on websites such as MSN, Time, and Bankrate. Lauren writes on a variety of personal finance topics for SoFi, including credit and banking. Revenues and expenses that are not linked directly to the business. This statement is straightforward and easy to go with while preparing the financial activity of your business.

- It lists items in different categories to make it convenient for users of the income statement to better understand the core operations of the business.

- Many smaller companies might use this method of presenting their income statement as is simpler and easier to understand.

- Use of our products and services are governed by ourTerms of Use andPrivacy Policy.

- It channels the effects of daily business activity into asset accounts , liability accounts , and owner’s equity accounts.

- The single-step income statement offers a straightforward accounting of the financial activity of your business.

Without supplying this data, small businesses can miss out on informing potential investors or lenders of their viability and lose out on opportunities to gain more operating capital. As we can see, all the revenues and expenses have been listed under one heading. Although a single-step income statement is simpler and easier to understand, it does not provide the level of detail required by an external user.

Operating Expenses Section

For example, there is no gross margin calculation, nor any expense breakdowns by department. This makes it more difficult for users to extract useful information from an income statement. The multi-step income statement is a more informative income statement.

What are the advantages of a multi step income over a single step income statement?

The siloed breakdowns in multiple-step income statements allow for deeper analysis of margins and provide more accurate representations of the costs of goods sold. Such specificity gives stakeholders a sharper view of how a company runs its business, by detailing how the gross, operating, and net margins compare.